As a dedicated cinephile, I’m keeping a keen eye on the future of theme parks, knowing full well that the journey back to the buzzing crowds and revenue levels of 2019 could take up to three years, given the persistent hurdles we’re navigating together.

In an interview with CoStar News back in August 2025, Dennis Speigel, CEO of International Theme Park Services, indicated that while they’ve opened new attractions and initiated expansion plans, the recovery process is far from over. He estimated it might take another 2 to 3 years for parks to reach their previous attendance and revenue levels before the lockdown. He attributed this slow progress to challenges such as severe weather conditions in 2025, ongoing economic uncertainties due to tariffs, and a decrease in consumer spending.

2019-level theme-park attendance in Florida was around 13% lower in recent times, with the gap partially explained by competitive pricing strategies and reduced international tourist numbers.

Operational Pressures: Weather and Staffing

According to Speigel’s observation, poor weather conditions and a lack of young, temporary workers (worsened by longer school schedules) have compelled several local parks to cut back their operations to only the weekend during off-peak times. This adjustment is unusual compared to past years.

Parks located in milder climates, which stay open all year, have observed increased attendance, yet numbers remain lower compared to before the pandemic. This indicates that the problem runs much deeper than just the weather conditions.

Impact on Consumer Behavior and Spending

As a devoted theme park enthusiast, I’ve noticed that, according to The Wall Street Journal, inflation and reduced discretionary income have led many families like mine to cut back on theme park visits. Interestingly, this trend seems to persist even as parks increase their per-capita revenue through premium offerings. This could potentially impede attendance growth. Even venues that focus on discounts experienced only modest gains, often accompanied by lower spending per visitor.

Spiegel noted that factors such as tariffs have created a considerable amount of doubt, leading some individuals to ponder whether it would be wise to delay purchasing an annual pass for a theme park.

Broader Industry Patterns: Revenue vs. Attendance

According to a study conducted by Themed Entertainment Association and AECOM, worldwide theme park earnings in 2022 exceeded those of 2019, mostly due to increased prices for premium offerings and improvements through apps, despite lower visitor numbers attending.

In the year 2022 alone, The Magic Kingdom welcomed approximately 17.1 million guests, which was lower compared to its visitor count in 2019.

Investments Continue Despite Headwinds

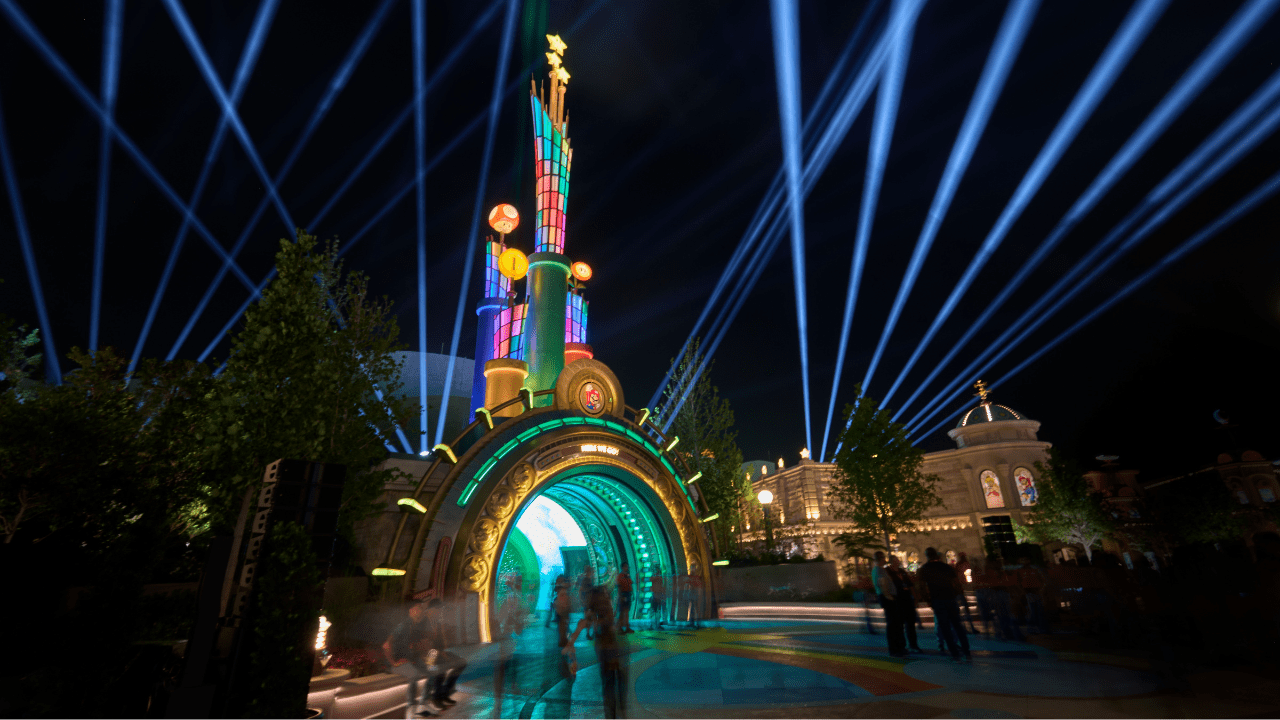

Leading companies continue to progress with major construction plans. By May 2025, Comcast had launched Epic Universe at the Universal Orlando Resort. Meanwhile, Universal has already debuted Horror Unleashed in Las Vegas, and plans to establish a Universal Kids Resort in Frisco, Texas.

As a movie buff, I can’t help but get excited about the massive transformation that Disney is embarking on! Over the next ten years, they are investing an impressive $60 billion into their Parks & Experiences division. This means we can expect new developments not only here in the U.S., but also overseas. It’s going to be quite a ride!

Conclusion

It seems that analysts’ predictions of a complete recovery within the next three years appear reliable, given the current data. However, while operators are actively pouring investments, challenges including unpredictable weather conditions, labor shortages, affordability issues, and dampened international travel remain obstacles to a swift rebound.

Read More

- Прогноз криптовалюты APT: прогнозы цены APT

- The Mandalorian & Grogu Trailer Just Broke A 47-Year-Old Star Wars Rule

- Золото прогноз

- Прогноз нефти

- Евро обгонит шекель? Эксперты раскрыли неожиданный сценарий

- Индийская рупия обгонит рубль? Эксперты раскрыли неожиданный сценарий

- Прогноз криптовалюты FLR: прогнозы цены FLR

- King of the Hill Season 15 Release Date Estimate, News & Updates

- Группа Аренадата акции прогноз. Цена акций DATA

- Fans Might Hate On 2005’s Fantastic Four, But I Think It Actually Gets One Character Very Right

2025-09-05 17:00