The initial offers for Warner Bros. are in, and they’re significantly lower than the $30 per share CEO David Zaslav was aiming for.

According to a report in On The Money, bids were submitted on Thursday at noon, and sources indicate the final amount will probably be significantly lower than Warner Bros. Discovery CEO David Zaslav was hoping for. With the serious bidders now known, the field of potential buyers is much smaller and clearer than many online discussions have suggested.

Three Real Bidders

The New York Post report confirms the bidding war centers on just three major players:

- Paramount Skydance

- Comcast

- Netflix

Paramount Skydance, led by David Ellison and financially supported by Larry Ellison, has made an offer of $23.50 per share, with expectations it will rise to approximately $25. However, those advising the Ellisons caution against going above the high $20s, and specifically want to avoid exceeding $27 per share.

Both Comcast and Netflix are under intense examination right now. According to The Washington Post, they could face major obstacles from the Trump administration when seeking approval for their plans, potentially causing lengthy delays. For Comcast, existing debt adds another layer of difficulty to the situation.

David Zaslav reportedly hopes for a deal price including the number three, but current negotiations aren’t indicating that’s achievable.

The Saudi Rumor

Here’s the twist that anyone following this saga online will notice.

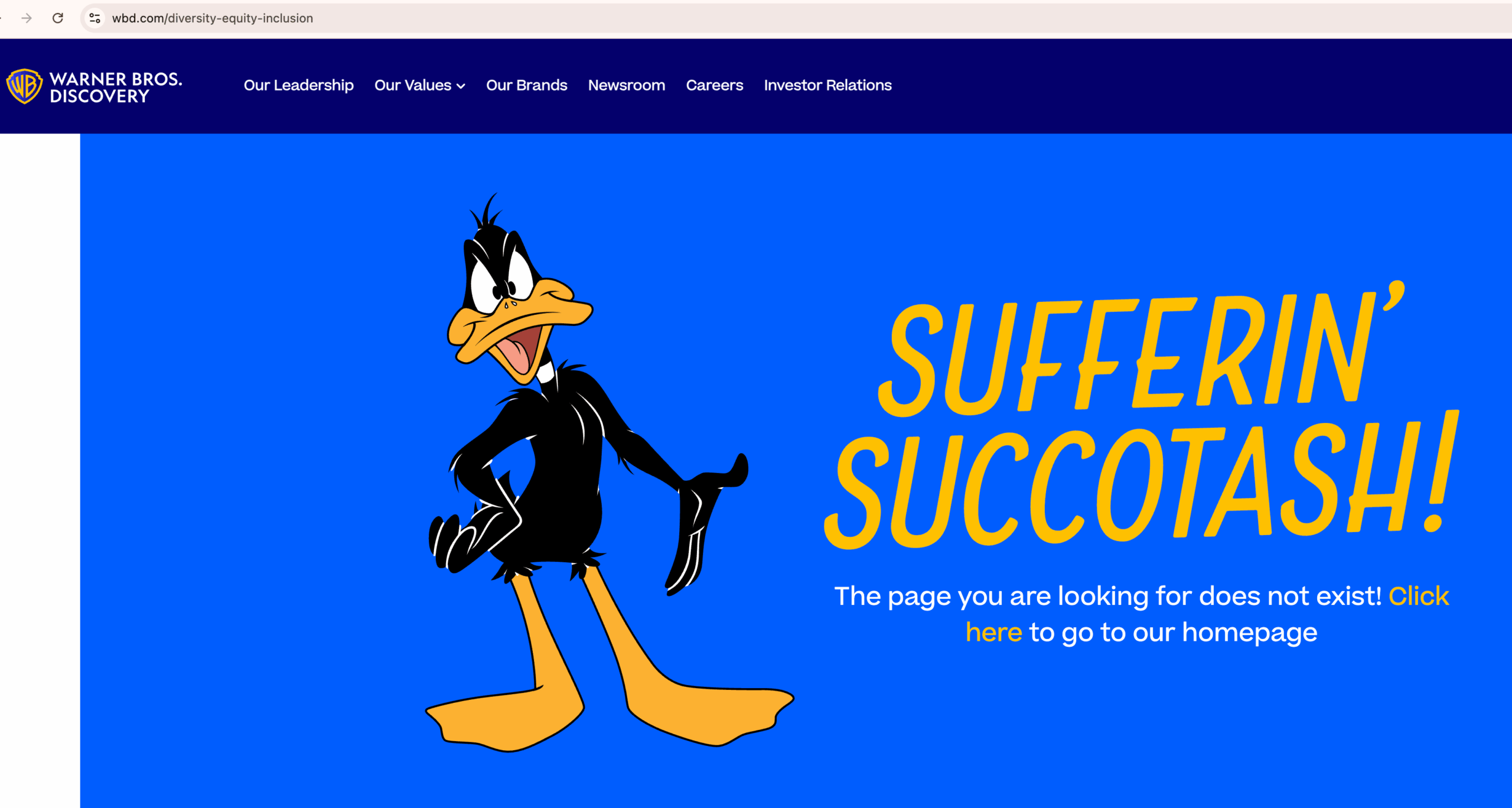

Rumors have been circulating on social media and within the entertainment industry suggesting that the Saudi Arabian Public Investment Fund (PIF) was on the verge of purchasing Warner Bros. Discovery, with some claiming a deal was nearly finalized.

Rumors were widespread and kept being discussed by fans and those following Warner Bros. Discovery’s plans.

But now that the formal Warner Bros. bids have actually arrived, something stands out clearly:

The PIF isn’t mentioned in any of the real reporting surrounding active bidders.

Not by sources. Not by analysts. Not in regulatory chatter.

This doesn’t necessarily mean the initial rumors were false, but it does show that any early discussions didn’t lead to a formal offer during the current bidding process. The fact that the rumor was so widely discussed earlier this month, but is now nowhere to be found, is significant in itself.

Politics, Not Just Price, Are Steering This Ship

A key takeaway from the Washington Post’s reporting is the political side of the story. It’s apparent the Trump administration favors the Paramount Skydance deal, particularly as it’s led by Ellison.

According to a source, Donald Trump likely wouldn’t support any agreement that benefits Brian Roberts or Reed Hastings. Meanwhile, the Ellisons, who have a close relationship with Trump, are anticipated to face a fast and simple six-month review from antitrust regulators.

Unlike the merger that just happened, Netflix and Comcast face a potentially lengthy and uncertain regulatory review process that could take two years or more, with no assurance it will be approved.

If you’re a board trying to sell a $70 billion media empire, timing matters just as much as price.

Zaslav Wants $30 — But the Market Isn’t Offering It

Sources say Zaslav was aiming for a price of at least $30 per share, which would value the company at approximately $70 billion.

The problem is simple: None of the real bidders are anywhere close to that.

Okay, so here’s the deal with the Warner Bros. Discovery sale. Right now, Paramount Skydance is the only one making a full offer for the entire company. Comcast and Netflix are just interested in buying parts, which could create a real mess with taxes and seriously slow down the whole process. To make things even more complicated, it seems like regulators are only likely to approve one bidder, leaving Warner Bros. Discovery’s board with very limited options. It’s a tricky situation, to say the least.

If no acceptable offers come in, the company’s board might go back to their original idea: divide Warner Bros. Discovery into separate businesses and consider selling them off again next year.

Reality Is Now in the Driver’s Seat

Okay, so now it’s all down to what happens next with these offers for Warner Bros. Discovery. It’s going to decide if they actually sell, try to get even better offers in a second round, or just completely back out of the deal. As a fan, I’m really hoping they make the right choice!

After a lot of talk and guessing, the real details are now coming to light, and they’re much more accurate than what people were saying online.

Read More

- ‘And Then The Chesty One Comes In.’ SNL’s Cut For Time Sketch Hilariously Reimagined Sydney Sweeney And Zendaya’s Euphoria

- Five Nights At Freddy’s 2 Review: The Video Game Movie Sequel Limbos Under The Low Bar Set By The First Film

- The Rising of the Shield Hero Season 4 Episode 4 Release Date, Time, Where to Watch

- Black Phone 2 Ending & Grabber’s Fate Explained

- JOJOLands Chapter 31 Release Date & Where to Read Manga

- Star Trek’s Smartest TNG Episode Is the Best Time-Travel Story in Sci-Fi TV History

- Elle Fanning’s Upcoming Apple TV Comedy Continues A Wildly Impressive Streaming Trend

- ‘I Think We’re In Trouble’: Miles Teller Gets Real About Fantastic Four Flopping (And Who Is Responsible)

- CBS Effectively Explains Why Tracker Got Rid Of Bobby & Velma

- Netflix’s New Western Series With Game Of Thrones Star Can Only Get Better After Becoming Global Hit

2025-11-22 01:00