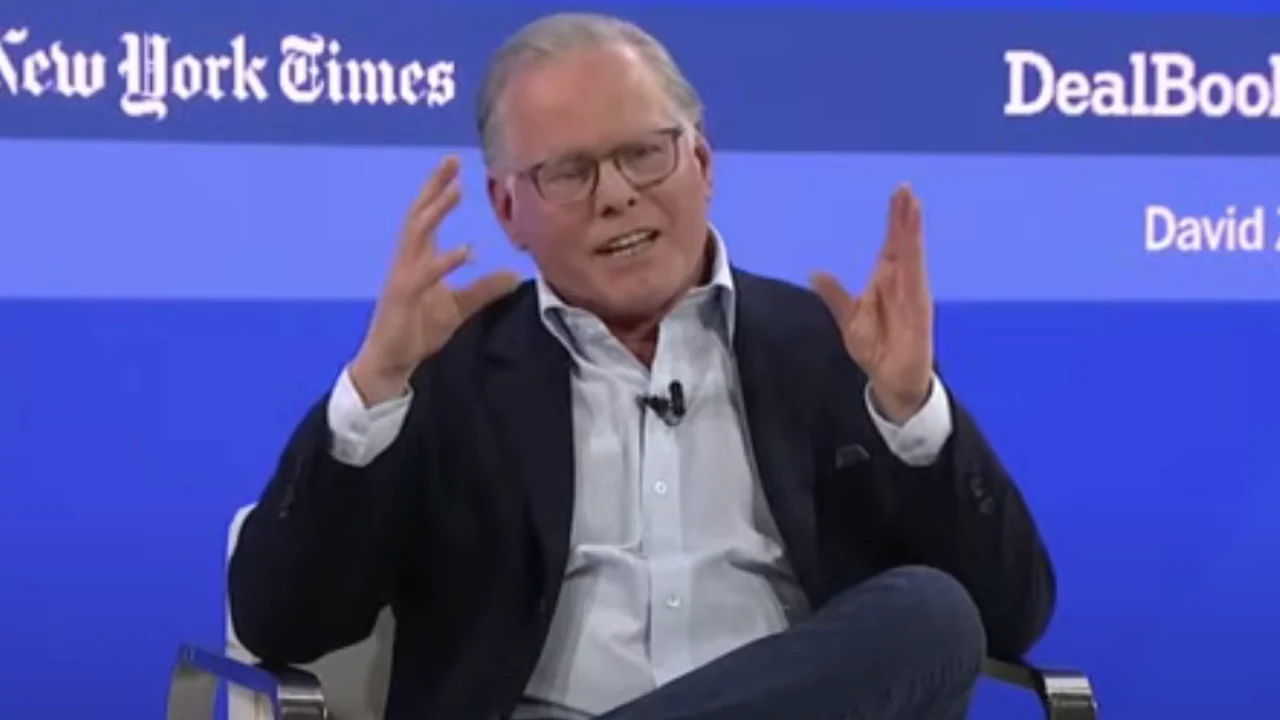

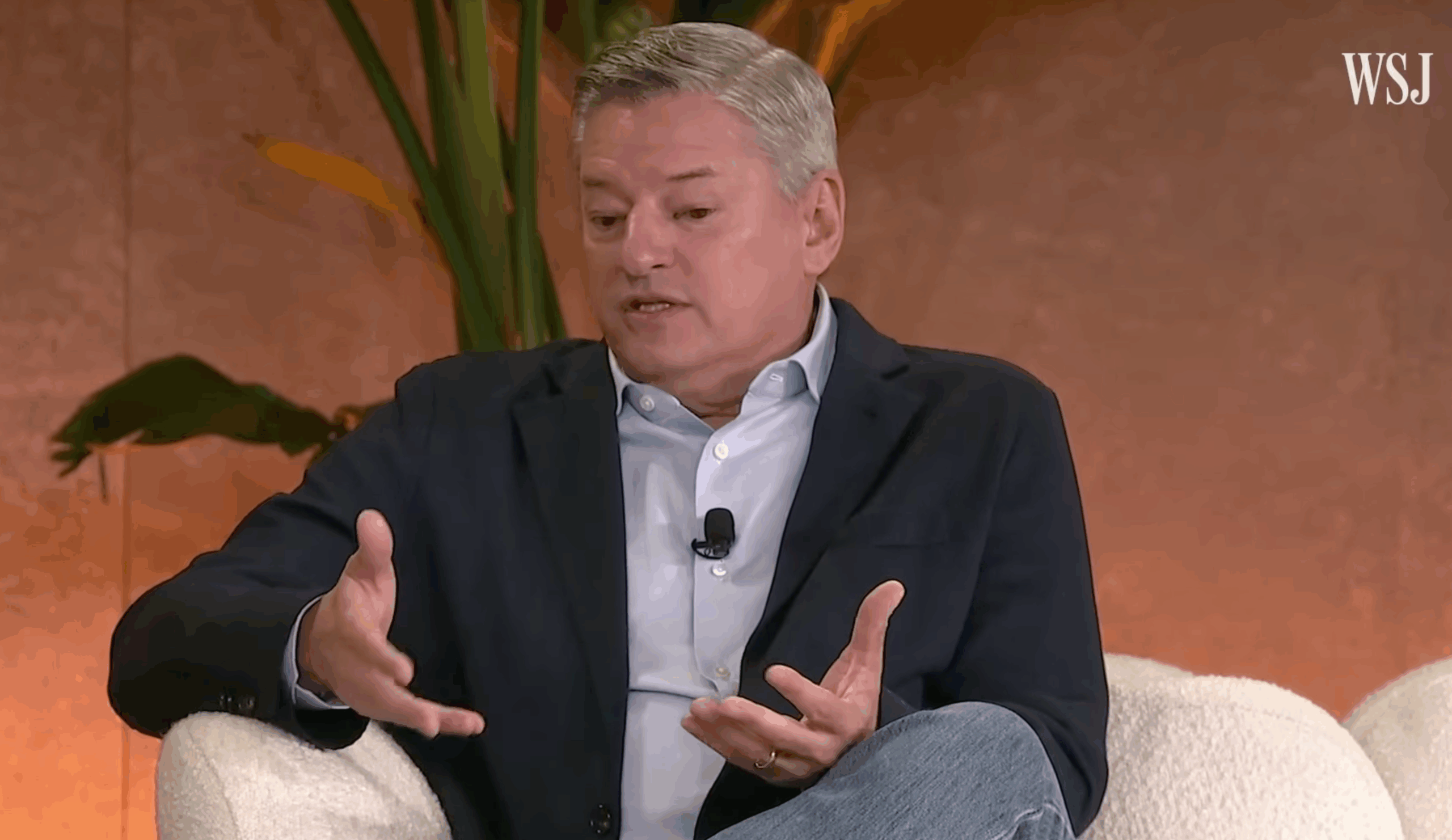

The fight for control of Warner Bros. is intensifying. Paramount Skydance has extended the deadline for its takeover offer, making it clear that David Ellison is determined to proceed, even though Warner Bros. Discovery has repeatedly refused his offer and is moving forward with a competing deal with Netflix.

Paramount Skydance has given Warner Bros. Discovery shareholders more time – until February 20, 2026 – to accept its offer to buy their shares for $30 each. The original deadline recently passed, but this extension keeps Paramount’s offer on the table. Paramount believes its all-cash offer is better than Netflix’s competing bid for the same Warner Bros. Discovery properties.

The disagreement isn’t simply about cost; it also concerns predictability, openness, and how Warner Bros. Discovery is assessing the worth of its upcoming changes to the company.

Paramount’s Case: Cash, Certainty, and Shareholder Pressure

Paramount Skydance believes its offer for Warner Bros. Discovery is stronger and more secure than Netflix’s. They highlight that their deal values the company at over $108 billion. Paramount has consistently argued that Netflix’s offer depends too much on optimistic predictions about future performance, especially regarding the expected separation of Discovery Global.

Okay, so with the deadline pushed back, Paramount has officially taken things a step further. They’ve filed some paperwork with the SEC basically asking Warner Bros. Discovery shareholders to vote against that deal with Netflix. As a fan, it seems like they’re done just talking behind closed doors and are now trying to rally the shareholders themselves to block the whole thing. It’s a pretty direct move, and shows they’re really trying to take control of the situation!

Paramount believes the problem is straightforward: shareholders are being asked to approve a significant deal without knowing exactly how much debt will go with the new Discovery Global company, or what that company will be worth after it’s separated from Warner Bros.’ main movie, TV, and streaming businesses.

Warner Bros. Discovery Pushes Back—Hard

Warner Bros. Discovery isn’t interested in further negotiations. They’ve announced that the vast majority of their shareholders – over 93% – have already turned down Paramount’s offer, calling it a poor deal. The Warner Bros. Discovery board has also unanimously agreed to move forward with a deal with Netflix instead.

The recent Netflix agreement, now structured as a fully cash payment, includes Warner Bros. Discovery’s studio and streaming services like HBO Max, but keeps Discovery Global as its own company. Netflix changed its offer to address a key argument from Paramount, which claimed its offer was better because it was entirely in cash.

Even with the changes made, Paramount believes the deal with Netflix still carries risks for shareholders. This is because it depends on the predicted future worth of Discovery Global, and there are concerns about how its debt will be handled and whether it will be profitable in the long run.

Discovery Global Valuation Becomes the Flashpoint

Much of the Paramount Warner Bros. conflict now hinges on Discovery Global.

Warner Bros. Discovery has shared estimates of how much Discovery Global could be worth, with the value per share varying based on different calculations. However, Paramount disagrees with these estimates, claiming that Warner Bros. Discovery’s own internal analyses actually suggest a much lower value. Paramount also believes the amount of debt assigned to Discovery Global could significantly decrease the payout shareholders would receive from the deal with Netflix.

Paramount is suing Warner Bros. Discovery, claiming they haven’t been fully transparent about the financial details of a planned spinoff. Warner Bros. Discovery has shared some more information with regulators, but Paramount still believes important questions haven’t been answered before shareholders vote on the deal.

Regulatory Risk Looms Over Netflix Deal

Another front in the dispute is regulatory scrutiny, particularly overseas.

Paramount Skydance has consistently voiced concerns that Netflix’s purchase of Warner Bros.’ studios and HBO Max would likely attract significant antitrust scrutiny in Europe. They argue that because Netflix is already the leading streaming service there, this deal could give them too much control of the market, stifle competition, and ultimately hurt those who create and distribute content.

Netflix believes the deal will be approved by regulators. They highlight their overall viewership and emphasize that strong competition exists from platforms like YouTube and traditional TV channels.

What Happens Next

Although Paramount has given more time for negotiations, the situation remains unresolved. The key event to watch is Warner Bros. Discovery’s upcoming shareholder meeting, where investors will vote on whether to accept the deal with Netflix or choose Paramount’s offer of a straight cash payment.

Currently, Warner Bros. Discovery’s leadership seems to be supporting Netflix. However, Paramount’s actions – continuing to make offers, increasing its legal efforts, and appealing directly to investors – indicate that the competition between Paramount and Warner Bros. is reaching a critical point.

It’s still uncertain if Netflix will ultimately acquire a major Hollywood studio, or if pressure from investors will cause them to change course.

It’s now obvious this conflict between companies is real and happening openly. The stakes are getting higher all the time.

Read More

- The Mandalorian & Grogu Trailer Just Broke A 47-Year-Old Star Wars Rule

- Прогноз криптовалюты APT: прогнозы цены APT

- Золото прогноз

- Прогноз нефти

- Группа Аренадата акции прогноз. Цена акций DATA

- I Expected Happy Gilmore 2 Would Be A Fun Sequel, But Was Surprised By Who My Favorite Character Turned Out To Be

- Franklin Richards vs. Scarlet Witch: Who Is More Powerful in MCU & Marvel?

- The Rising of the Shield Hero Season 4 Episode 6 Release Date, Time, Where to Watch

- Welcome to Derry Just Officially Confirmed Its Shining Connection (& It’s Perfect)

- 4 Years Ago, Ted Lasso Released The Show’s Most Rewatchable Episode

2026-01-23 21:57